BOP Apna Ghar Scheme

Punjab Bank has launched the Apna Ghar scheme for homeless people. People who do not have their own house will now be able to get their own house. In this article, you will be provided complete details about the scheme so that if you do not have your own house, you can get your own house through this scheme.

Actually BOP Apna Ghar is a House Financing facility for:

- Purchase of constructed house

- Purchase of plot and construction, thereon

- Construction of house on self-owned plot

- Renovation of house.

Let me tell you more: you can get a loan of up to one crore rupees to get your house through this scheme. And here, if we talk about repaying the loan, then the loan can be paid back in easy 25-year installments. If you want to get more information, then you need to read the article completely.

Also Read: CM Punjab Announced “Apni Chaat Apna Ghar” Scheem

Who can apply for BOP Apna Ghar?

Four categories of people can apply for BOP Apna Ghar, whose details are provided below. If you fall into any one of these categories, then you can apply to get your house very easily. And you can become the owner of your own house.

- Salaried Individuals (SI)

- Self Employed Professional (SEP)

- Self Employed Businessman (SEB)

- Non-Resident Pakistani (NRPs)

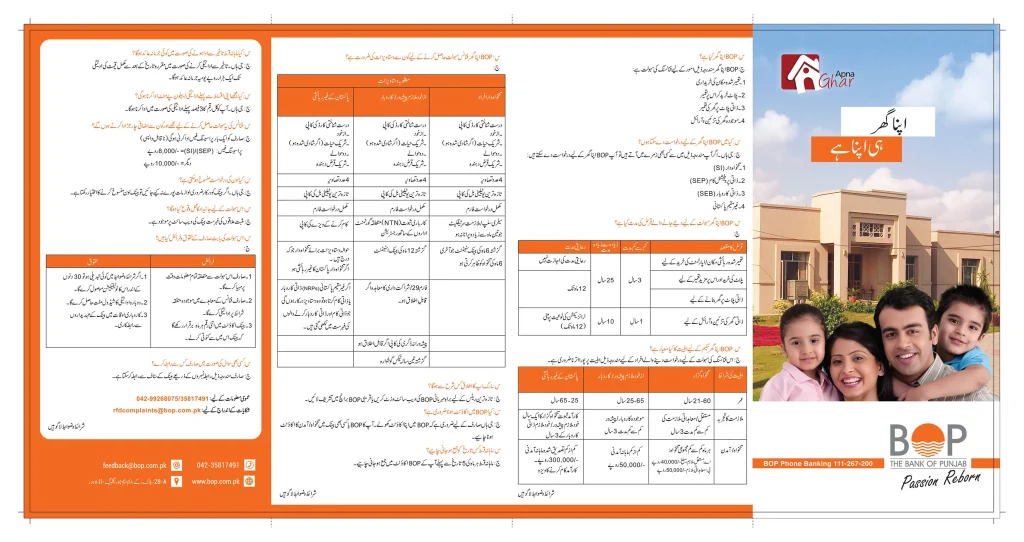

Tenure Of Housing Finance Facility Under BOP Apna Ghar Scheem

| Purpose of Loan | Minimum Tenure | Maximum Tenure | Grace Period |

|---|---|---|---|

| Purchase of constructed residential house / apartment | 3 Years | 25 Years | No grace period allowed |

| Purchase of plot & construction thereon | 3 Years | 25 Years | Up to 12 months |

| Construction of house on self-owned plot | 3 Years | 25 Years | Up to 12 months |

| Renovation of self-owned house | 1 Year | 10 Years | Based on nature of transaction (up to 12 Month) |

Eligibility Criteria For Bop Apna Ghar Scheem

If you are interested in owning your own home and you want to get a loan for it, then you have to meet the eligibility criteria given below. Eligibility criteria may vary depending on the applicant’s category, as detailed below.

| Eligible Items | SI | SEP/SEB | NRPs |

|---|---|---|---|

| Age | 21-60 Years | 25-65 Years | 25-65 Years |

| Job Experience | Permanent/Contractual employees minimum 3 years job experience | Minimum years in current business/ profession 3 years | Have valid documentary proof of at least 1nyear of SI or 3 years for SEB/SEP |

| Salary/Income | Minimum gross salary per month: a. Permanent emp PKR 40,000/- b. Contractual emp PKR 50,000/- | Minimum monthly income PKR 50,000/- | Minimum monthly verifiable income PKR 300,000/- have a valid work visa |

Also Read: CM Punjab Electric Bike Scheme: Online Registration 2024

Necessary documents for availing loan

Salaried Individuals (SI)

- Copy of Valid CNIC (Self, Spouse (It married), Two References, Co-borrower (if any)

- Four Photographs

- Copy of Last Paid Utility Bill

- Complete Application Form

- Salary Slip (Last 3 months) OR Employer Certificate

- Bank statement

Self Employed Professional / Self Employed Businessman (SEP) (SEB)

- Copy of Valid CNIC (Self, Spouse (It married), Two References, Co-borrower (if any)

- Four Photographs

- Copy of Last Paid Utility Bill

- Complete Application Form

- Proof of Business (NTN, Registration with concerned Governing Body etc.)

- Bank Statement for last 12 months

- Form 29 / Partnership Agreement, If applicable

- Copy of Professional Degree, if applicable

- Tax returns for Last 3 years

Non-Resident Pakistani (NRPs)

- Copy of Valid CNIC (Self, Spouse (It married), Two References, Co-borrower (if any)

- Four Photographs

- Copy of Last Paid Utility Bill

- Complete Application Form

- Copy of Valid Work Visa

- Refer to Documents listed in Salaried Individual if NRP is SI

- Ref to Documents listed in Self Employed Professional / Businessmen if NRP is SEP or SEB

Procedure to Apply for Apna Ghar Scheme

If we talk about applying, the procedure for applying is very easy. But before applying, it is very important for you to know a few things that I am providing you here with complete details. Remember, you must have a Bank of Punjab account to apply. If you do not have a bank account, you can go to any nearby Bank of Punjab branch and open your account.

And if we talk about applying for a loan, the procedure for it is very easy. If you fulfill the eligibility criteria as per the above conditions, then you can go to any nearest branch of the Bank of Punjab and submit your application to get the loan. Note that if you do not meet the eligibility criteria mentioned above, your application may be cancelled. So please read all the eligibility criteria mentioned above carefully before applying.

Conclusion

Finally, let us tell you that the Bank of Punjab has started the Apna Ghar scheme for the homeless. People who want to get their own house can purchase it by getting a loan in easy installments. In this article, you have been provided with complete details about this scheme. Through the information provided, you can submit the application to get the loan very easily. Further, if you need any kind of information, you can visit your nearest branch of the Bank of Punjab to get the information.